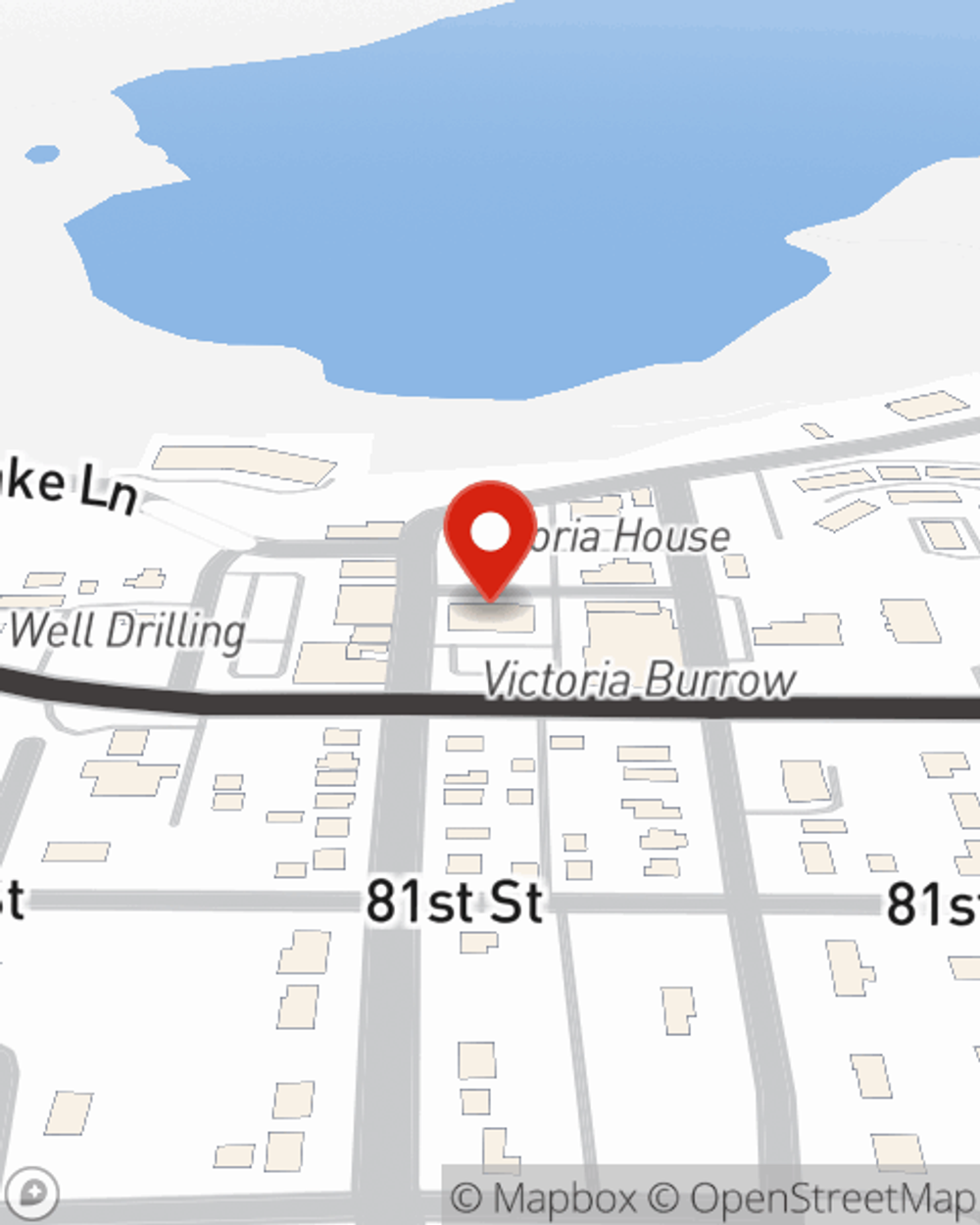

Business Insurance in and around Victoria

Researching protection for your business? Look no further than State Farm agent Sam Hennemann!

Helping insure small businesses since 1935

Business Insurance At A Great Value!

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, trades, retailers and more!

Researching protection for your business? Look no further than State Farm agent Sam Hennemann!

Helping insure small businesses since 1935

Keep Your Business Secure

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Sam Hennemann. With an agent like Sam Hennemann, your coverage can include great options, such as worker’s compensation, commercial auto and artisan and service contractors.

Let's review your business! Call Sam Hennemann today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Sam Hennemann

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.